With the new tax year underway, it could be a perfect time to review your finances and consider how to make the most of your allowances and investments for the year ahead to gain optimum benefit. Below we consider some of the areas where utilising the allowances available could make a huge difference and potentially save you a substantial amount of money.

ISA Allowance

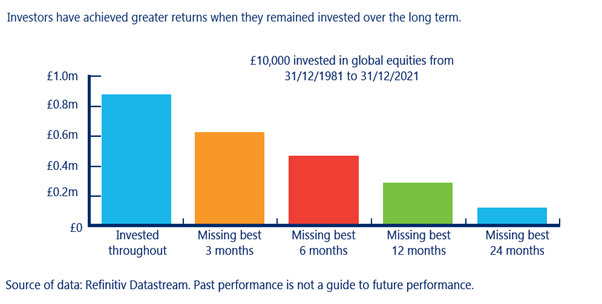

The new tax year means a fresh ISA allowance of £20,000. ISAs can provide tax free benefits for your savings and investments, allowing you to benefit from higher returns over the long term. Maximising your allowance early can allow more time for your investments to grow, free from capital gains and income tax.

Pension Contributions

Most pension savers can contribute up to £60,000 per annum into their pension, however, advice should always be taken as an individual’s allowance can be restricted to an amount less than £60,000 due to complexities with the rules. Similar to the ISAs, pensions are tax efficient savings vehicles which can be accessed from the minimum pension age. Your pension can be used to invest in various different investments including cash savings, investment portfolios and commercial property.

Also, if you haven’t utilised your allowance from the previous three years, it is possible to carry it forward and boost your pension pot further, subject to certain criteria.

Capital gains tax allowance

From April 6 2024, the capital gains tax allowance was reduced from £6,000 to £3,000 per person. If find yourself in a position where you have maximised both your pension and your ISA allowance, you could consider investing into a General Investment Account and crystallise your gains on an annual basis using your capital gains tax allowance.

Dividend allowance

Rather than investing in growth assets, there is the option to invest into income distributing funds. Any dividend received on unwrapped investments can be claimed tax free if it falls within your Dividend Allowance, the allowance fell from £1,000 to £500 on the 6 April 2024.

Inheritance Tax

You are able to give up to £3,000 each year completely free of any inheritance tax (IHT) liability, this can be a useful way to reduce a potential inheritance tax bill, as well as helping out your family with a financial gift.

The tax-free inheritance threshold is £325,000 per person, above which 40% rate of tax is due (subject to other allowances).

You can gift more should you wish but if you died within seven years of the gift, the recipient could be subject to a large IHT bill. You are also able to carry over your allowance to the following tax year so if you haven’t used any of your allowance during the previous tax year, you could potentially gift up to £6,000 without any tax liability.

Get in touch

For further information or advice on how you can plan ahead to make the most of your finances and maximise the tax allowances available to you, contact a member of our financial planning team today to talk through your personal circumstances by emailing financialplanning@pmm.co.uk or call 01254 679131.

The information contained within this article is purely for information purposes and does not constitute financial advice.